Greetings, my dear friends. We’re all well aware that CA exams are not a mere walk in the park; they demand serious attention. It’s imperative to approach them with utmost dedication. Crafting a study plan in alignment with your capacity to tackle diverse subjects is the key.

Kick off by delving into the subjects you’re passionate about, and dedicate substantial effort to comprehending concepts in the areas where your track record isn’t as strong. Drawing from my personal journey and the wisdom imparted by senior peers, allow me to guide you through a prudent approach to kickstart your CA exam preparations.

Phase I: Foundation Matters

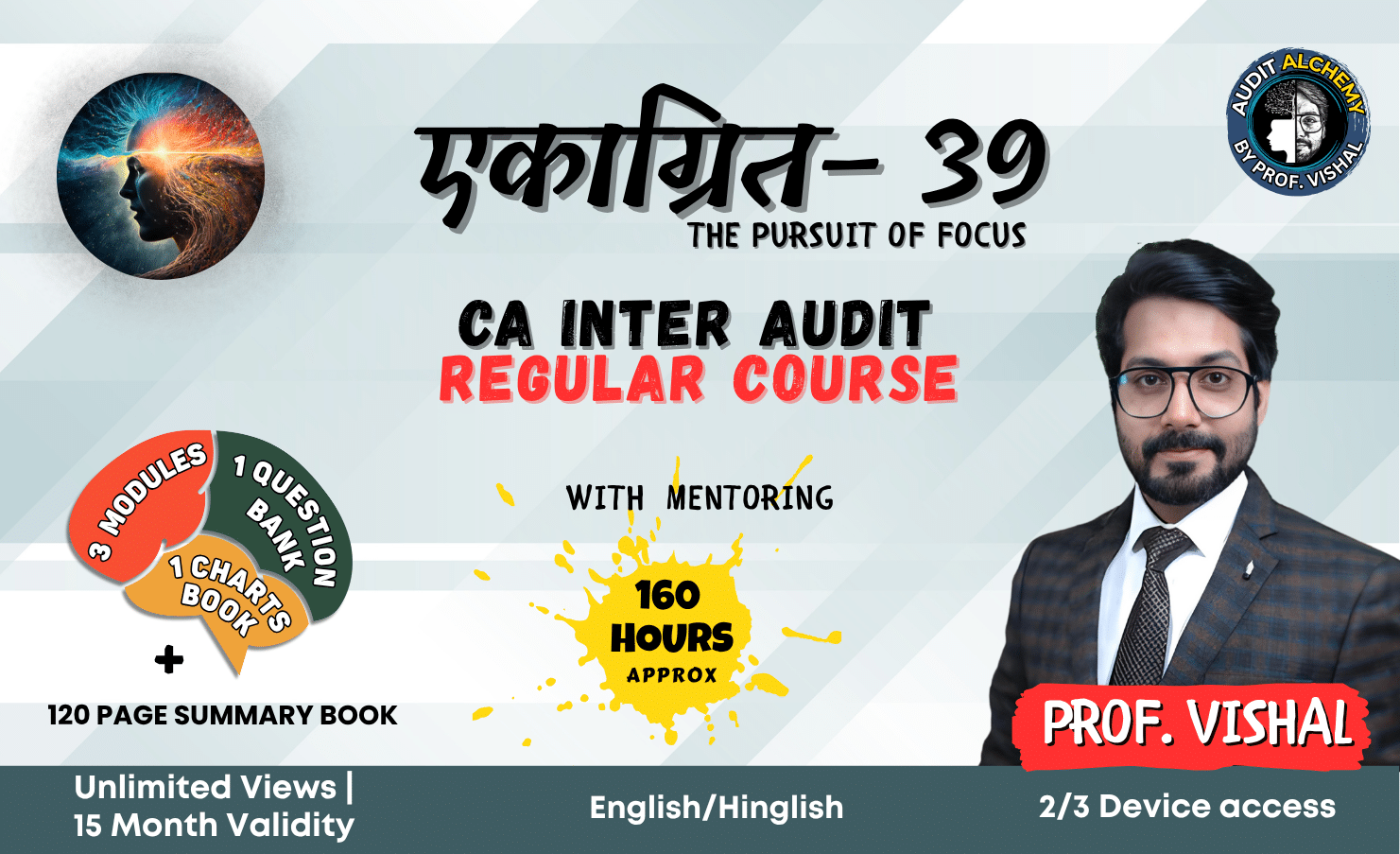

Upon registration with the Institute, you’re bestowed with a treasure—the STUDY MATERIAL. Regardless of whether you’re opting for classes or embarking on self-study, commence with the MODULES. These study materials beautifully unravel fundamental concepts.

A solid grip on these concepts guarantees your ability to tackle any challenge that comes your way. Immerse yourself in the MODULES, for its significance becomes vividly evident after the exams. For additional perspectives, you may refer to reference books available in the market. While absorbing the content during your first read, identify pivotal questions encompassing a multitude of adjustments.

Compile concise notes; these notes will serve as invaluable companions during exams.

Read more: CA Final and Intermediate Exam Exemption Guidelines

Phase II: Navigating Practical Realms

Post completing your study material, shift focus to solving the compilations pertaining to practical subjects. These compilations encapsulate problems from past years’ exams, thereby granting insight into potential exam queries. By delving into the compilations, you accomplish your first revision.

Phase III: Revitalizing and Reinforcing

Return to the MODULES and reference books for a revision, bearing time efficiency in mind. Utilize this phase to iron out any lingering doubts. Subsequently, immerse yourself in the SUGGESTED question papers from the past four to five years.

Solving these papers under exam conditions proves an invaluable technique, enabling you to master the art of managing your time efficiently during the actual examination.

Phase IV: Staying Current and Informed

Maintain your knowledge base by staying updated. It’s imperative to remain well-informed prior to the exams. Stay abreast of all amendments in taxation, laws, accounting, and auditing standards. Engage with new case laws and amendments, as they are likely to surface in the exam papers.

Phase V: Culmination and Composure

Distill your learnings into short and potent notes, focusing on pivotal questions. As the finish line approaches, refrain from introducing new material; sticking to your plan is vital. Maintain your composure, cultivate a tranquil mind, and entrust the rest to the higher forces.

Remember, my friends, conquering CA exams is a journey, not a mere destination. Begin with a well-structured foundation, let your dedication bloom, and navigate each phase with unwavering determination. Your success is a culmination of preparation, persistence, and perspective.